Understanding Teeth Whitening and Insurance

Teeth whitening, also known as bleaching, is a popular cosmetic dental procedure designed to lighten the color of your teeth and remove stains or discoloration. While it’s a sought-after treatment for enhancing smiles, understanding whether your insurance covers it can be tricky. Generally, dental insurance policies are designed to cover treatments considered medically necessary, such as those addressing disease or injury. Cosmetic procedures, like teeth whitening, often fall outside this scope. However, some scenarios can change this, and this guide will provide you with a comprehensive overview of how to navigate the world of teeth whitening coverage, insurance plans, and how to potentially maximize your benefits. It’s important to recognize the distinction between cosmetic and necessary dental procedures.

Cosmetic vs. Medically Necessary Teeth Whitening

The primary factor influencing whether teeth whitening is covered by insurance is its classification as cosmetic or medically necessary. Cosmetic procedures aim to improve the appearance of your teeth, such as whitening for aesthetic purposes. Most dental insurance plans do not cover cosmetic treatments because they are not deemed essential for oral health. Medically necessary procedures, conversely, address a specific medical need, such as treating a disease, injury, or functional impairment. These are more likely to be covered by insurance. The line between cosmetic and necessary can sometimes blur, especially when discoloration stems from a medical condition or injury. Knowing the difference between these two is the first step in understanding your insurance coverage.

When Is Teeth Whitening Considered Medically Necessary?

In rare instances, teeth whitening may be considered medically necessary. This usually occurs when discoloration results from a medical condition, treatment, or injury. For example, if teeth discoloration occurs because of a root canal, trauma to the teeth, or certain medications, your dentist might argue that whitening is necessary to restore the tooth’s structure or to prevent further health issues. Another case might involve tooth discoloration due to a congenital condition. In such instances, the insurance company may review the case, along with supporting documentation from your dentist, to decide whether to cover the procedure. The key is to establish a clear medical reason behind the need for teeth whitening.

Cases Where Whitening Might Be Covered

There are specific scenarios where your insurance provider might consider covering teeth whitening. If discoloration is the direct result of an accident, such as a sports injury or car crash, and impacts the health of your teeth, a portion or the entire cost of the procedure may be covered. Moreover, some dental insurance plans offer cosmetic benefits, although these are often limited, with certain restrictions, and require you to pay a higher premium. If you have specific medical conditions, such as those caused by certain medications or treatments, you might also be able to claim. To increase your chances, your dentist has to document the medical necessity, showing the impact on your oral health.

Impacted Teeth Whitening for Accident

When an accident causes damage to your teeth, teeth whitening could be considered for coverage by your insurance. If the accident leads to discoloration or staining of your teeth, and this is documented by your dentist, your insurance might cover the costs. The dentist must provide a detailed report, including X-rays and other forms of documentation, as proof of the damage. Some insurance plans may even cover the whitening, even if it is not directly connected to the injury, as long as it is recommended by the dentist. Check your policy and discuss options with your dentist and insurance provider. This ensures that you receive the necessary treatment while minimizing out-of-pocket costs.

Types of Insurance That Might Cover Whitening

Knowing which insurance plans are more likely to provide coverage is crucial. Dental insurance is your primary focus. While most standard dental plans don’t cover cosmetic procedures, some offer cosmetic benefits. These plans may have higher premiums, but they potentially reduce out-of-pocket costs. Another type of insurance is health insurance, which sometimes covers dental procedures if medically necessary. Accidental injury plans are also crucial. If the discoloration is a result of an accident, this type of insurance can be beneficial. Finally, some employers offer a health savings account (HSA) or flexible spending account (FSA), allowing you to set aside pre-tax money to pay for eligible health expenses, including dental work.

Dental Insurance Plans

Dental insurance plans are your first stop when seeking coverage for teeth whitening. There are several types of dental plans, including indemnity, PPO (Preferred Provider Organization), and HMO (Health Maintenance Organization). Indemnity plans give you more flexibility in choosing a dentist. PPO plans, however, provide coverage within a network of dentists, although you can still see an out-of-network dentist, but the coverage might be limited. HMO plans have lower premiums, but they restrict you to a network of dentists and usually require a referral from your primary care dentist for specialist visits. Although not all dental plans cover whitening, it’s important to review the specifics of your plan, looking for any cosmetic benefits. Some plans may offer a certain amount of coverage or discounts on cosmetic procedures. Always check your plan’s policy details and limitations.

Health Insurance Plans

Health insurance plans may sometimes cover teeth whitening if it’s deemed medically necessary. This is usually only in specific cases. For example, if the discoloration is a result of a medical condition or treatment, like certain medications or radiation therapy, the health insurance might cover the procedure. The key is to prove a link between your condition and the need for teeth whitening. Your dentist must document this medical necessity and submit it to your insurance. You may need a referral from your primary care physician to see a specialist. The extent of coverage will depend on your health insurance plan, so review the policy and speak to your insurance provider to understand the terms and conditions of your coverage.

Finding a Dentist That Accepts Your Insurance

Finding a dentist who accepts your insurance is a key part of getting teeth whitening covered. Start by checking your insurance provider’s website for a list of in-network dentists. This ensures the dentist accepts your insurance. You can also ask your insurance company for a list of preferred providers in your area. When you’ve chosen a dentist, verify with the office that they accept your insurance plan before scheduling an appointment. Ask the dental office if they have experience with submitting claims for cosmetic procedures like teeth whitening, as they will know the right procedures. This proactive approach ensures a smooth claims process and minimizes any out-of-pocket expenses. You should not hesitate to consult with a few different dentists to find the best fit.

The Cost of Teeth Whitening Procedures

The cost of teeth whitening varies widely depending on the type of procedure and where you are. In-office whitening is usually more expensive than at-home treatments. The price range can range from a few hundred to over a thousand dollars. At-home whitening kits, including those available over the counter, are usually less expensive, starting from around $20 and up. Factors that affect the total cost include the dentist’s fees, the materials used, and any additional services. If your insurance covers any part of the procedure, it can significantly lower your costs. Keep in mind that some dental offices offer payment plans or financing options. You must always request a detailed estimate of the costs from your dentist before starting the procedure.

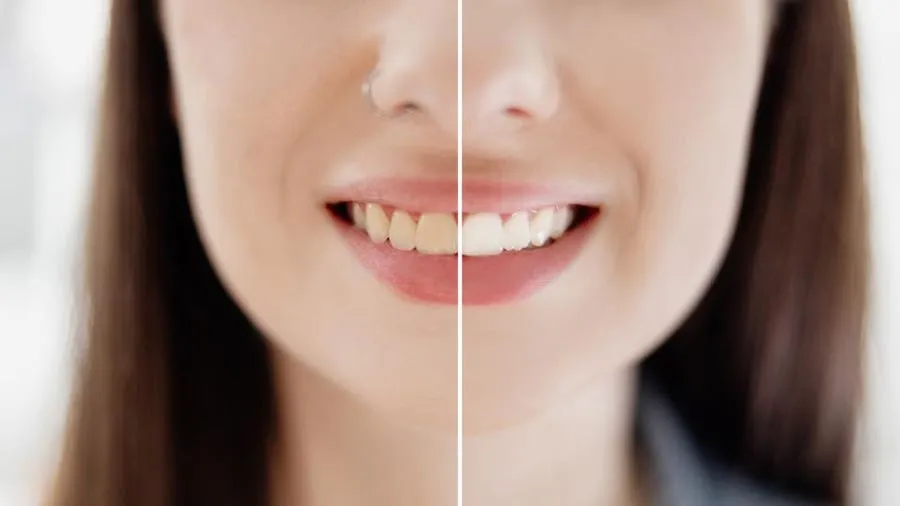

In-Office Teeth Whitening

In-office teeth whitening is the most expensive option, but it usually yields the fastest and most effective results. The dentist applies a high-concentration bleaching agent directly to your teeth, and they may use a special light or laser to accelerate the whitening process. An in-office procedure typically takes about an hour and offers immediate results. The cost of in-office whitening often depends on the dentist’s location, the specific products used, and the complexity of the treatment. While insurance coverage for this procedure is less common, it is possible if it is deemed medically necessary or if your plan includes cosmetic benefits. Talk to your dentist about the possibility of submitting a claim, providing any required documentation.

At-Home Teeth Whitening Kits

At-home teeth whitening kits are a more affordable option and allow you to whiten your teeth at your convenience. You can purchase these kits from your dentist or over the counter. The kits usually contain custom-fitted trays or strips filled with a lower concentration of bleaching agents, which you wear for a specific amount of time each day. At-home kits are often less expensive. Coverage by insurance is very rare, as this is considered cosmetic. Many insurance plans do not cover over-the-counter products. If your dentist prescribes an at-home kit, it is still considered a cosmetic procedure. Always follow the dentist’s instructions carefully to achieve the best results and avoid any potential side effects. Before choosing this method, talk to your dentist about any pre-existing dental conditions.

Tips for Maximizing Your Insurance Coverage

To increase your chances of getting teeth whitening covered, it’s essential to take the right steps. Start by reviewing your insurance policy, paying attention to the details about cosmetic procedures and any exclusions. Next, discuss your options with your dentist. They can assess your situation and determine whether there’s a medical necessity for the procedure. Your dentist can also provide the required documentation and submit the necessary claims. Be prepared to provide medical records. Submit a pre-authorization request to your insurance provider before starting the procedure. This helps you find out whether a procedure is covered and how much you will have to pay. Keep detailed records of all communications with your insurance company, including dates, names, and outcomes. This will help if there are any issues with your claim.

Talking to Your Insurance Provider

Communicating with your insurance provider is a crucial step in understanding your coverage and preparing for the process. Start by contacting your insurance company and asking specific questions about teeth whitening coverage. Ask about the specific criteria for coverage, whether there are any pre-authorization requirements, and which documentation is required. Make sure you understand your policy’s terms and conditions. If you’re unsure about any policy details, request a written explanation from your insurance provider. Also, ask if they cover cosmetic procedures. Your dentist can help you during your communication. They can provide all needed documentation and explain the medical need for the procedure. Keep records of all communications, including dates, times, and the names of the people you spoke with. This will be helpful if you have any issues.

Submitting a Pre-Authorization Request

Submitting a pre-authorization request is a smart move. This involves getting approval from your insurance provider before you start the procedure. It provides certainty about your coverage and helps you avoid unexpected costs. To submit a pre-authorization request, you will need to provide your insurance company with information about the procedure, the medical necessity (if any), and the estimated costs. You may need to include documentation from your dentist. Your dentist can provide the necessary documents and help you complete the request. It is always best to request a pre-authorization. The insurance company will review your request and let you know whether it will cover the procedure. If approved, you will receive a written confirmation. If denied, you can understand why and explore other options. This process helps you make an informed decision.

Alternatives and Other Options

If insurance coverage is unavailable, or the cost is too high, consider other options. Many dentists offer payment plans to make cosmetic procedures more affordable. You can also explore financing options through third-party lenders specializing in healthcare. If you are unable to pay for teeth whitening, consider over-the-counter whitening products. These are less expensive, but you should consult your dentist before use. Another option is to discuss alternatives with your dentist, such as dental bonding or veneers. Before starting any dental procedure, determine your budget. Check if your dentist offers any promotions or discounts. Always make the best financial decision based on your individual circumstances and preferences.

In conclusion, whether teeth whitening is covered by insurance depends on various factors. It’s typically considered a cosmetic procedure and therefore not covered. However, medical necessity, injury, or specific plan benefits can change this. You need to understand the specifics of your insurance plan, discuss with your dentist, and consider all options. By being proactive and informed, you can navigate the process and make the best decision for your dental health and financial well-being. Remember to always prioritize clear communication with your insurance provider and dentist.